Finance Think has published the study “Empowering Western Balkan Economies: Attractiveness and Transparency of State Aid in the Region.” The link to the full analysis is available here.

The goal of this study is to examine the types, amounts, and measures of state aid provided by the governments of the six Western Balkan countries to domestic and foreign companies, aiming to foster innovation, technological advancement, productivity, and more.

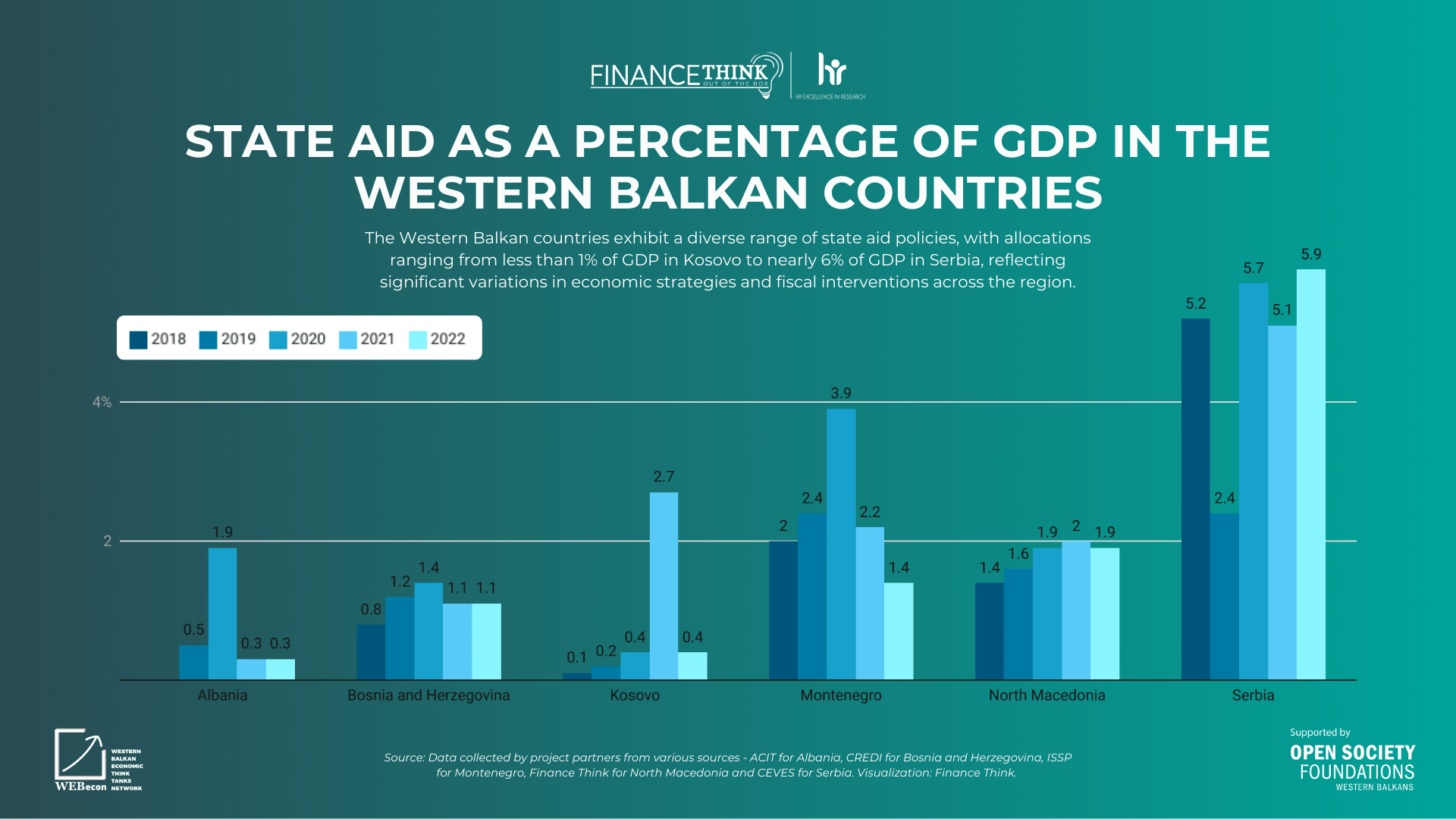

State aid in the Western Balkan countries ranges from below 0.5% of GDP in Kosovo and Albania to 5.9% of GDP in Serbia (2022 data). North Macedonia allocates state aid amounting to 1.9% of GDP or €253 million (Figure 1).

In general, all countries have numerous state aid measures targeting three segments: farmers, domestic companies, and foreign companies. To some extent, these measures are similar across the countries, especially those aimed at farmers and foreign companies operating in free economic zones. Low transparency and lack of information regarding the measures and the amounts of allocated aid are additional commonalities among the analyzed countries.

More specifically, the results show that state aid allocated to farmers accounts for more than half of the total state aid in four countries (Kosovo, Bosnia and Herzegovina, Montenegro, and North Macedonia). On the other hand, this aid cannot be linked to increased agricultural and livestock production, suggesting the need to reassess the purpose, model, and distribution methods of such aid. For example, in North Macedonia, a significant reduction in livestock production aid has been observed over the past two years, while meat production has consistently increased. Although aid for plant production support varies from year to year, vegetable production remains relatively stable.

State aid targeting domestic companies varies between countries, particularly in terms of the sectors being supported. More than half of the aid for domestic companies in Albania is directed toward manufacturing and tourism. Serbia is the only country allocating a larger portion of state aid to the development of small and medium-sized enterprises. In North Macedonia, over 90% of the aid is allocated across all sectors, with the remainder targeting manufacturing, energy, and tourism. Similar trends are observed in Bosnia and Herzegovina and Kosovo.

State aid should not function as a form of social assistance for companies. It should lead to increased productivity, innovation, competitiveness, job creation, and technological development for both the recipient company and the economy as a whole. An increased amount of state aid allocated to innovation correlates with an improved ranking of the Macedonian economy in the Global Innovation Index. The introduction of aid for new start-ups and spin-off companies is associated with an increased number of newly established companies. On the other hand, despite the continuous increase in aid for new employment, training, and employee specialization, labor productivity in the country has not improved.

All Western Balkan countries, except Kosovo, offer a wide range of attractive measures to attract and support foreign investors. The state aid scheme for foreign investors in North Macedonia is rated the most transparent, straightforward, and attractive compared to other countries. All foreign companies, regardless of location, can utilize the measures outlined in the Law on Financial Support of Investments, which, according to the analysis, account for two-thirds of state aid allocated to foreign investors. For the other analyzed countries, data on aid for foreign investors is incomplete (Serbia and Albania) or non-existent (Bosnia and Herzegovina and Montenegro), highlighting the need for increased transparency among the institutions responsible for managing and overseeing this type of aid.

The recommendations from the analysis are focused on three segments:

- Improving regional cooperation to align state aid policies, enabling a more integrated market that can attract cross-border investments and stimulate regional development. This can be achieved through joint initiatives, sharing best practices, and creating regional funds addressing common challenges.

- Focusing state aid on strategic sectors by promoting innovation, digitalization, and sustainability. In the future, aid should target sectors such as green technologies, renewable energy, and digital infrastructure, positioning the countries as competitive players in the global market.

- Enhancing transparency and accountability of relevant institutions by introducing more robust mechanisms for monitoring and reporting the types and amounts of state aid allocated.